- Why Real Estate Best Long Term Investment Choice for Investors in 2025

- 1. Tangible Asset With Intrinsic Value

- 2. Consistent Appreciation Over Time

- 3. Cash Flow From Rentals

- 4. Hedge Against Inflation

- 5. Strategic Use of Leverage

- 6. Tax Efficiencies (Varies by Jurisdiction)

- 7. Portfolio Diversification

- 8. Control and Value-Add

- 9. Long-Term Wealth & Legacy

- Smart Tips to Get Started (and Stay Safe)

Real estate best long term investment—if you’ve heard this phrase and wondered why it keeps coming up, you’re not alone. Property remains a favorite for long-horizon investors because it blends stability, steady appreciation, and passive income in a way few assets can match. While stocks and other markets can be volatile, real estate offers a tangible path to building wealth over decades. This guide breaks down nine reasons why many investors consider real estate the best long-term investment and how you can approach it strategically.

In this blog, we’ll explore seven powerful reasons why property continues to outperform other investments when it comes to security, appreciation, and wealth creation.

Why Real Estate Best Long Term Investment Choice for Investors in 2025

When it comes to long-term wealth, real estate consistently outperforms other asset classes. Investors gain both stability and appreciation, making it one of the most reliable ways to secure financial growth.

1. Tangible Asset With Intrinsic Value

Unlike paper or purely digital assets, property is physical. You can improve it, insure it, and utilize it. That tangibility helps many investors stay disciplined through market cycles.

2. Consistent Appreciation Over Time

Historically, property values trend upward over the long run as demand, infrastructure, and incomes grow. Educational overviews repeatedly highlight appreciation + equity build-up as core benefits of real estate.

3. Cash Flow From Rentals

A key reason people call real estate best long term investment is dual return streams: monthly rental cash flow plus long-term value growth. Well-selected rentals can cover financing costs while equity compounds.

4. Hedge Against Inflation

As prices rise, rents and replacement costs typically increase too. That means well-located property can preserve purchasing power over time—one of real estate’s most practical benefits.

5. Strategic Use of Leverage

Real estate uniquely allows you to control a high-value asset with a relatively small down payment via financing. Over time, amortization and appreciation grow your equity on a leveraged base.

6. Tax Efficiencies (Varies by Jurisdiction)

Depending on local rules, investors may benefit from interest deductions, depreciation, or capital-gains treatments. These incentives can enhance after-tax returns relative to some other assets. For broad market context and data sources, professional bodies maintain ongoing research hubs (see NAR Research & Statistics: nar.realtor/research-and-statistics).

7. Portfolio Diversification

Adding real estate can smooth portfolio volatility because it often behaves differently from equities or bonds—helpful for long-term wealth plans.

8. Control and Value-Add

Unlike many investments, you can directly improve real estate—renovations, better property management, or repositioning—which can boost rent, value, and overall returns.

9. Long-Term Wealth & Legacy

Property can be passed to future generations, creating continuity and a lasting financial foundation. For many families, this intergenerational value is the ultimate reason real estate best long term investment becomes a core strategy.

Smart Tips to Get Started (and Stay Safe)

Run the numbers: Model cash flow (rent, expenses, maintenance) and stress-test for vacancies or rate changes.

Do legal due diligence: Verify title, approvals, and encumbrances before you commit.

Think long-term: Real estate shines over years, not weeks.

Keep learning: Bookmark reputable, evergreen resources like Investopedia’s Real Estate Investing hub for fundamentals and frameworks (Investopedia: Real Estate Investing).

In short, if your goal is to build durable wealth, real estate best long term investment is a strategy worth serious consideration. Its mix of appreciation, income, tax efficiency, and control is hard to beat over multi-year horizons.

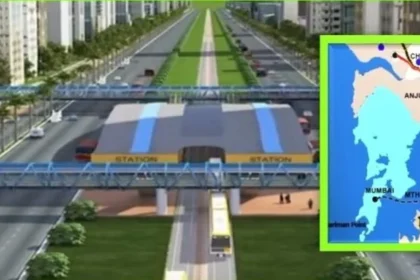

📩 Ready to explore real opportunities? Contact Tisari Mumbai for guidance on curated plots and projects across the MahaMumbai region.

Or read our related guide: Is Real Estate a Good Investment in 2025?